Our firm has seen a recent increase in ketamine clinic clients, both domestic and foreign (including for ketamine clinic buyers engaged in M&A, see here and here). In both camps, certain questions keep cropping up regarding starting, operating, and managing a ketamine clinic venture in the states. And what’s abundantly clear is that many people don’t understand that delving into a ketamine clinic really means having to comply with myriad existing healthcare regulations and laws in the United States on the state and federal level, which are interspersed with a multitude of court cases, administrative decisions, and state attorney general opinions that regularly alter compliance standards (indeed, having a well thought out compliance plan is pretty key for these clinics). When people hear of ketamine clinics, they tend to think they’re dealing with an emerging psychedelic medicine in the health and wellness market. Nonetheless, while the use of ketamine to treat mental health issues is definitely an emerging area in medicine, its place in the healthcare regulatory world is already well-established and failure to comply accordingly has serious consequences.

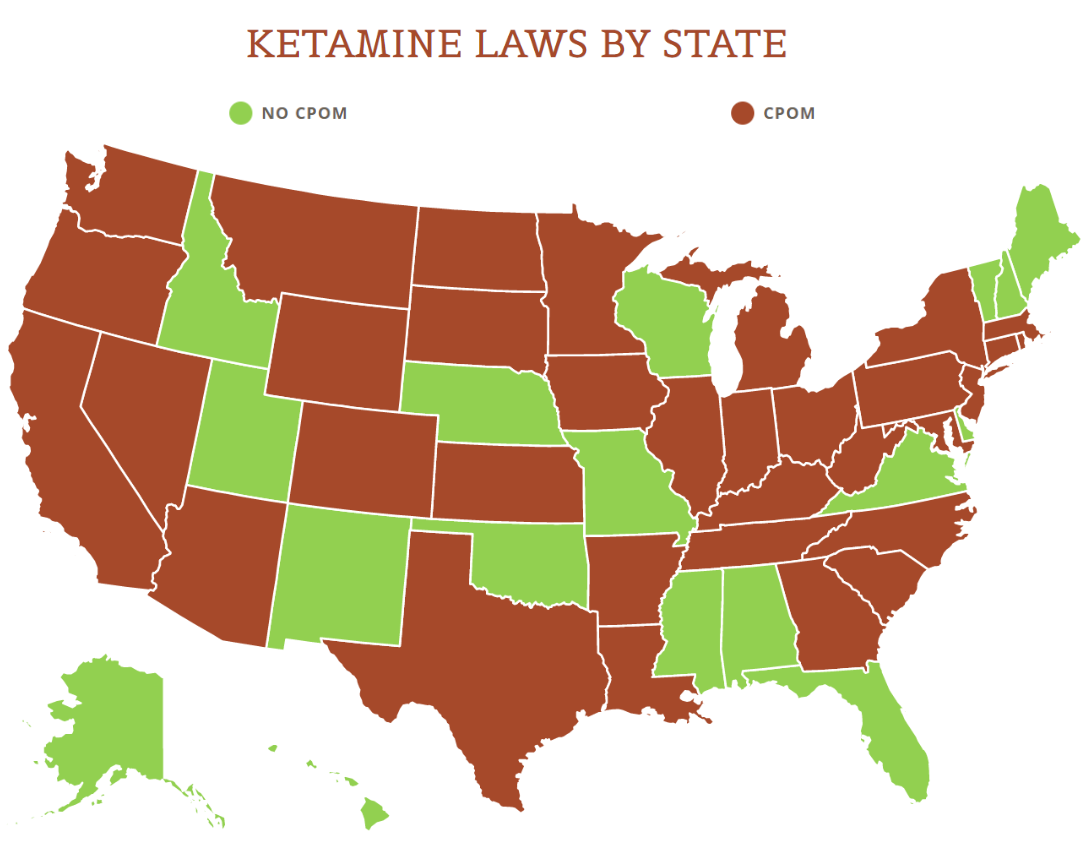

View the US Map of Ketamine Legality

In turn, here are the top 6 questions we’ve been getting lately around ketamine clinics:

Isn’t the regulation of ketamine clinics just like adult-use/medicinal cannabis businesses?

No, it’s not. In fact, the two are treated wildly differently by federal and state governments. Pursuant to the federal Controlled Substances Act, cannabis is an illegal schedule I controlled substance while ketamine is on schedule III. Cannabis cannot be lawfully prescribed by physicians; physicians can only “recommend” its use to patients based on individual state laws that identify who qualifies as a patient for its use. Ketamine can be lawfully prescribed, and it’s typically used as a surgical anesthetic even though it is actually a psychedelic (ketamine infusions for mental health disorders constitute “off label” uses, which is a well-established area in medical care). Cannabis faces an overall lack of access to financial institutions as well as IRC 280E, and ketamine certainly does not. Cannabis is not regulated by the Food and Drug Administration and federal healthcare laws generally don’t apply to state-licensed cannabis businesses. Ketamine clinics, depending on patient protocols and a host of other operational factors, are subject to countless federal and state healthcare laws (including HIPAA) that are discussed below. What cannabis businesses and ketamine clinics share, however, is the patchwork quilt of state-by-state regulation that dictates who can own these businesses as well as how they must be operated and the kinds of licenses they must secure to open their doors. That’s about it though.

Can anyone own and operate a ketamine clinic?

This answer depends on state law. We’ve written previously about the sticky issue of the corporate practice of medicine doctrine (specifically in California) (“CPOM”) and how CPOM dictates that only physicians can be shareholders in professional corporations through which they practice medicine. Ketamine administration through an IV, orally, or nasally (with esketamine) is a practice of medicine that requires the supervision of a physician. In CPOM states, only “professional” business entities owned by physicians and/or other enumerated, licensed healthcare providers can take ownership of the business through which they administer ketamine treatments, and no unlicensed persons can invest or take ownership in those entities (and this is where the MSO/friendly PC model comes into play). There are other states though, like Florida, where unlicensed individuals and businesses can take ownership in medical practices because there is no CPOM bar (although there may be other requirements in play like in Florida, for example, where additional licensing is required from the state if non-physicians have an ownership interest in the medical practice). And other states like Arizona have a form of CPOM established through case law but it’s not as aggressive as statutory CPOM in other states.

How are a Management Services Organization (“MSO”) and a “professional” business entity (“PC”) supposed to do business together in a CPOM state?

Very carefully is the answer here. The most aggressive CPOM state we’ve seen so far is probably New York where recent court cases have really narrowed what an MSO can do when it comes to a PC (including a prohibition on holding or having access to any bank accounts on behalf of the PC). Generally though in a CPOM state, the setup is that an MSO provides non-medical services to the PC via a management services agreement (“MSA”). In the MSA, the MSO needs to steer very clear of taking over or assisting the PC in any way when it comes to clinical decision-making and patient care management, which is strictly the responsibility of the PC. Really, the job of the MSO should be to assist the PC with only administrative tasks and issues, and it can also provide certain resources and assets to the PC without violating CPOM. Some typical examples of MSO services include the provision of real estate for the clinic space, equipment, administrative staffing, IT systems and support, tax management, budget establishment and maintenance, and licensing maintenance.

How does an MSO make money from an MSA?

Obviously, an MSO is entitled to compensation for services rendered under the MSA. At the same time, certain forms of consideration are going to violate CPOM and may also violate other existing state and federal fee-splitting laws. In certain states, any kind of fee-splitting is completely prohibited and in other states, it is allowed but in a limited capacity, and in any event, all the way around, federal and state health care laws dictate that the consideration must be “fair market value” for services rendered, so sweetheart deals and/or astronomical inflation of service fees are also a big no.

Do ketamine clinics take insurance?

Yes, they can. Although many are still self-pay mainly for two reasons: 1. there’s likely not enough clinical evidence yet to show that ketamine works for certain kinds of pain relief as advertised, and as a result, insurers treat it as experimental and won’t pay for it; and 2. as long as patients are willing to pay and the demand is there, the better business decision is likely to remain self-pay (in order to avoid the administrative headache and payment lag time that’s often attendant with insurance). When insurance is involved, whether private or government, the clinic then faces the advent of compliance with state and federal Stark and anti-kickback laws and regulations, which have civil and criminal penalties if violated.

What licenses do you need to operate a ketamine clinic?

Again, this is completely dependent on state law requirements and is also dictated by services rendered at the clinic and patient protocols set by the overseeing physicians. Without a doubt, physicians need DEA licenses to prescribe and administer ketamine, but the clinic may also need its own DEA license and/or registration (see here) for drug storage and/or additional and/or multiple state clinic licenses that range from outpatient drug treatment to just general health care facilities.

Ketamine clinics are in a league of their own because of the off label nature of the treatments and the specific kinds of liabilities associated with that. At the same time though, ketamine clinics must still adhere to the bevy of existing healthcare regulations that affect any medical practice, so physicians, licensed health care providers, and lay parties looking to venture in the space need to really understand healthcare compliance under state and federal law before entering the market.