One of the primary restrictions that ketamine clinics run into when retaining a Management Services Organization (MSO) are fee-splitting prohibitions. Fee splitting is a state law concept and can vary from state to state. In some instances, though, fee-splitting can also lead to issues under the federal healthcare fraud and abuse laws, as discussed below.

Fee splitting can often be hard to define. It is akin to what the late Supreme Court Justice Potter Stewart famously tried to explain with “hard-core” pornography, or what is obscene, by saying, “I know it when I see it.”

American Psychiatric Association Guidance on Fee Splitting and Ketamine Clinics

As the American Psychiatric Association (APA) explained:

Fee splitting occurs when a patient is referred by one doctor to another in return for a portion of the fee that the referral doctor receives for treating the patient. Both the [American Medical Association] and APA consider this practice unethical for a number of reasons; primary among them is that fee splitting undermines patient trust. A patient should be able to rely on his or her physician to make referrals based only on the skill and quality of the physician to which the patient is being referred. Moreover, fee splitting puts a physician at risk for running afoul of federal and state antikickback laws.

While the above quote relates to physicians splitting fees, the same concept applies when a physician or ketamine clinic pays excessive fees to an MSO. As one example used by the APA noted:

While there is nothing wrong with paying for the use of office space, the cost should not be a percentage of the patient’s charges; instead, it should be a flat fee based on what is reasonable and customary for renting such space in that location.

Examples of state law prohibitions

When it comes to state fee-splitting laws, there is a wide variety in the laws. Examples are set forth below:

Arizona

An Arizona physician may be disciplined for charging a fee for services not rendered or dividing a professional fee for patient referrals among or between healthcare providers or healthcare institutions or engaging in contractual arrangements that have the same effect. A.RS. § 32-1401(27)(v).

California

In California, a physician may not offer, receive, or accept any rebate, refund, commission, preference, patronage dividend, discount, or other consideration, whether money or other form, as compensation or inducement for referral of patients, clients, or customers to any person. Cal. Bus. & Prof. Code § 650(a). However, there are exceptions, including, a physician may accept payment or receipt of consideration for services other than referral of patients which is based on a percentage of gross revenue or similar type of contractual arrangement if the consideration is commensurate with the value of services furnished or fair rental value of any premises or equipment leased or provided by the recipient to the payer. Cal. Bus. & Prof. Code § 650(b).

Florida

Physicians are prohibited from splitting fees generated from patient care; this includes paying or receiving any commission, bonus, kickback, or rebate, or engaging in any fee-splitting arrangement in any form whatsoever with a physician, organization, agency, or person, directly or indirectly, for patients referred, including to hospitals, nursing homes, clinical labs, ambulatory surgical centers, or pharmacies. Fl. Stat. § 458.331(1)(i). Florida likewise has certain exceptions, including, under its patient brokering statutes, for:

- certain payments, compensation, or financial arrangements within a group practice,

- payments to healthcare provider or facility for consultations services,

- payments by health insurance regarding goods or services payable under a health benefit plan,

- payments to or by a healthcare provider, facility, or provider network entity regarding goods and services payable under a health benefit plan, including Medicare and Medicaid,

- payments by a healthcare provider or facility to an information service which provides information to consumers, if certain criteria are met,

- insurance advertising gifts lawfully permitted, and

- payments of commissions or fees to nurse registry for referring persons providing healthcare services to clients of the registry. Fl. Stat. § 817.505(3).

Texas

A physician in Texas commits an offense if the physician employs or agrees to employ, pays or promises to pay, or rewards or promises to reward any person, firm, association, partnership, or corporation for securing or soliciting a patient or patronage. A physician commits an offense if the physician accepts or agrees to accept a payment or other thing of value for securing or soliciting patronage for another physician. Tex. Occ. Code § 165.155.

Washington State

The license of any physician may be revoked or suspended if he or she has directly or indirectly requested, received, or participated in the division, transference, assignment, rebate, splitting, or refunding of a fee for, or has directly or indirectly requested, received, or profited by means of a credit or other valuable consideration as a commission, discount, or gratuity in connection with the furnishing of medical, surgical, or dental care, diagnosis or treatment or service, including X-ray examination and treatment, or for or in connection with the sale, rental, supplying or furnishing of clinical laboratory service or supplies, X-ray services or supplies, inhalation therapy service or equipment, ambulance service, hospital or medical supplies, physiotherapy or other therapeutic service or equipment, artificial limbs, teeth, or eyes, orthopedic or surgical appliances or supplies, optical appliances, supplies or equipment, devices for aid of hearing, drugs, medication or medical supplies or any other goods, services or supplies prescribed for medical diagnosis, care or treatment, except payment, not to exceed thirty-three and one-third percent of any fee received for X-ray examination, diagnosis, or treatment, to any hospital furnishing facilities for such examination, diagnosis, or treatment. Wash. Rev. Code § 19.68.030.

As evident from above, state fee-splitting laws are all over the map. And, often, these statutes and regulations do not have many defined terms or other guidance for interpretative purposes. This is in stark contrast to the federal anti-kickback statute that has safe harbors, ways to request opinions from the Office of Inspector General, case law, regulations, and other guidance. While some states have case law that helps to further illuminate the fee-splitting prohibition, the case law can be sparse.

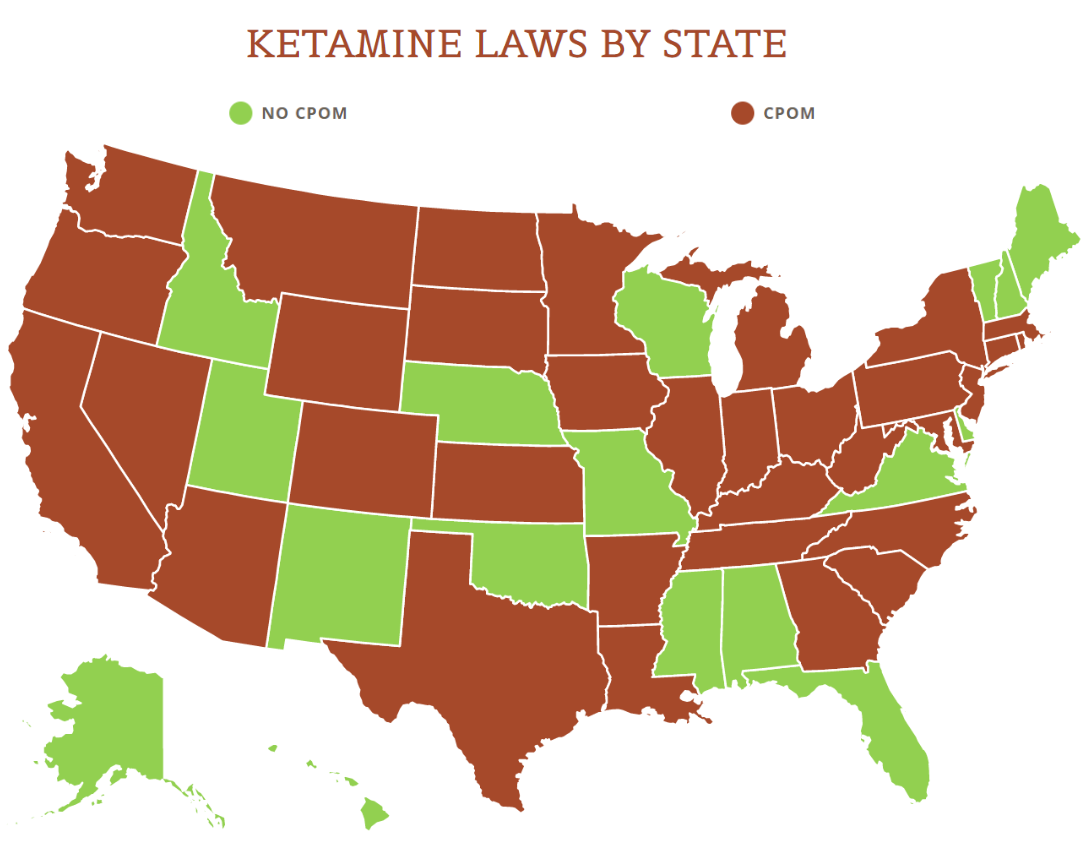

View the US Map of Ketamine Legality

Concluding thoughts

Does this mean that a physician can never hire and pay an MSO for ketamine clinic services? The answer is a resounding no. But great care must be taken to ensure the services provided by the MSO do not conflict with state fee-splitting prohibitions. A fee appraisal by a third-party expert can help allay any concerns. The appraisal sets forth fees that are “fair market value,” which if observed by the MSO and physician, should provide protection against fee-splitting allegations. A physician can always hire an accountant, lease space, lease equipment, and so on. But, when all of these services are combined and housed with an MSO, it is vitally important to ensure the fees paid to the MSO do not run afoul of fee-splitting prohibitions.

While beyond the scope of this post, fee-splitting prohibitions and the federal anti-kickback statute often have overlapping concepts. Practices and MSOs that are subject to the federal fraud and abuse laws (which include the anti-kickback statute), must take extra caution due to many of the severe penalties associated with such laws.