My law firm represents a large number of cannabis operators in Oregon, Washington and California. Some of these operators own the land they trade on; others simply lease. Whenever we are lucky enough to meet the client before the onset of cannabis activity, our first question is often whether the target property is mortgaged, or if it is owned free and clear. If the property is mortgaged, we ask “by whom?” If the answer is “a bank,” we tend to say, “let’s talk about that for a minute.”

Your standard institutional mortgage contains language allowing the mortgagee/lender to call the loan if the property is being used to conduct “illegal activity.” Lenders won’t budge on that provision: it relates back to federal lending guidelines, and attempting to pare back that language is impossible. If a borrower acquires a bank loan with the secret intention of operating or leasing to a cannabis business, that borrower is running a risk of foreclosure, to say nothing of allegations of fraud.

When a bank discovers that cannabis is being grown, processed, held or sold on its mortgaged property, it has the option, under contract, to call the loan. This means the bank can declare the entire mortgage balance due and owing on the spot. In practice, if a loan is in good standing it won’t always get called; but if a bank learns that cannabis is being traded on the property, a real possibility exists that the mortgage will get called. And refinancing with the lender will be all but impossible.

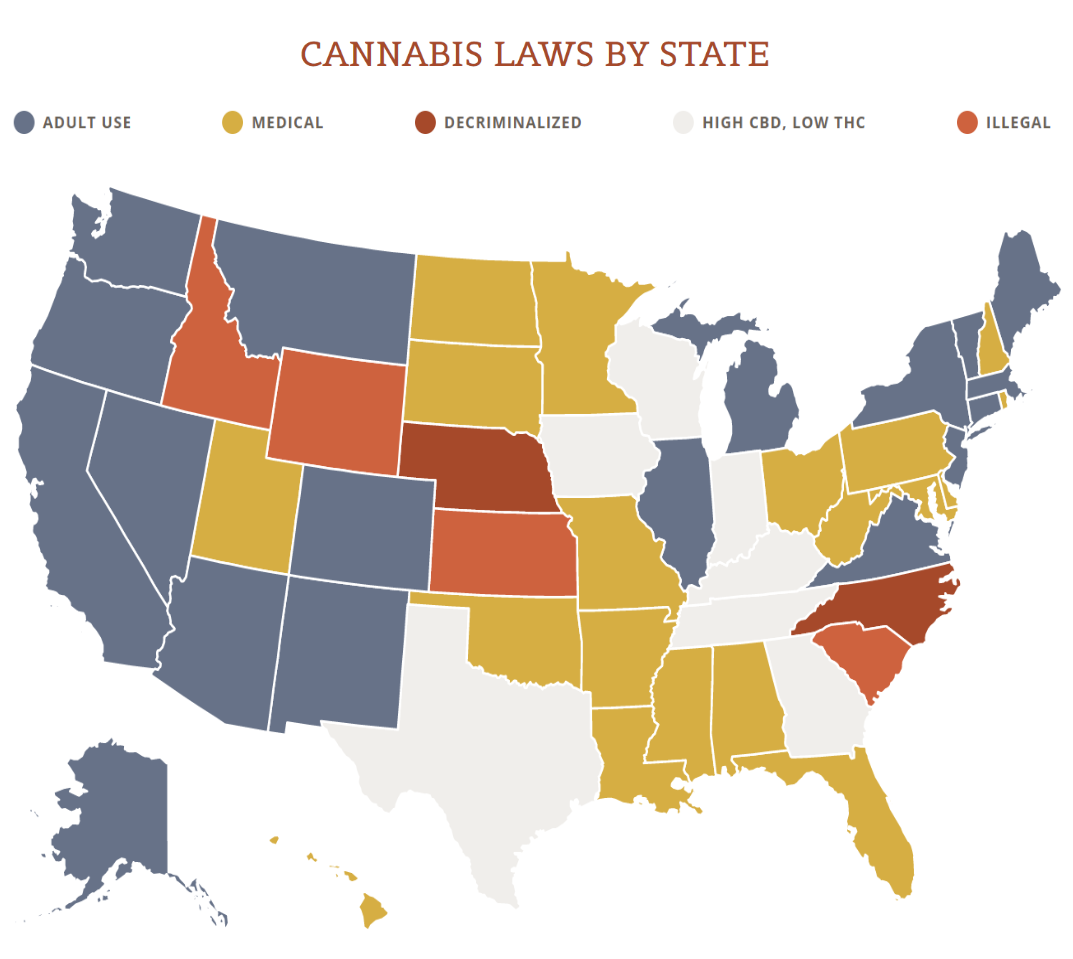

View the US Map of Marijuana Legality

Although banks typically do not troll their commercial loans looking for pot merchants, many loans require borrowers to inform lenders about tenants and new leases on the property. When a bank decides to call a loan due to cannabis activity, the bank may give the mortgagor a limited window of time to cure the defect (stop the cannabis activities), or to find alternative lending. Given the realities of business investment and operations, the strictures of leases and the high cost of private lending, this can cause tremendous headaches.

There is no work-around for the “illegal activities” issue in institutional lending, but that hasn’t stopped some folks from trying. Among other creative ideas, we recently saw one owner give a second, unrecorded mortgage to a cannabis operator as “insurance” against the first loan getting called. Not only would this approach fail to prevent the first mortgage from getting called, it would typically allow the first mortgagee to declare the balance of its loan payable immediately, as “due on sale.” Such an action could wipe out the junior, unrecorded mortgage interest in any subsequent foreclosure.

Finding a cannabis property is not always easy, but it’s important to understand how the property is financed (or otherwise encumbered) before you sign a lease or begin operations. If you intend to purchase a cannabis property and cannot pay cash, seller financing is a popular option we have written about elsewhere. Otherwise, it’s hard money or trying to fool the bank. Neither of those is a good business plan.

Need Help With Washington Cannabis Law?