Contents of this Article:

- What is Sinosure?

- How does Sinosure Work?

- Sinosure in the United States: its law firms and collection agencies.

- China Factory Problems Lead to China Sinosure Problems

- Real Life Sinosure Nightmares

- What Makes China Sinosure so Dangerous?

- What You Should NOT Do if Under Siege by Sinosure

- What TO DO if Under Siege by Sinosure

In this post, we explain what Sinosure is, what causes Sinosure to put foreign companies in its crosshairs, why Sinosure is so dangerous, and, how to fight back and win against it.

Like clockwork, the downturn in China’s economy is leading to a big uptick in companies and lawyers contacting our international litigators for help in fending off Sinosure threats.

1. What is Sinosure?

Sinosure is China’s Export and Credit Insurance Corporation and it insures most of China’s exports and it then pays its manufacturer-policyholders when a foreign company fails to pay for product received from those manufacturers. Sinosure is a Chinese government funded insurance company established to support China’s foreign and trade development and cooperation.

Nearly all Chinese companies that provide credit to foreign businesses do so only because Sinosure insures their invoices.

2. How does Sinosure Work?

As explained by Wikipedia, Sinosure is a massive China-based export and credit insurance company:

Sinosure offers coverage against political risks, commercial and credit risks. This includes short-, medium- and long-term export credit insurance, investment insurance, bond and guarantee business, debt and capital retrieval business and credit assessment business. Investment guarantees cover political risks such as currency and remittance restrictions, expropriation and nationalization, sovereign breaches of contract and war.

Sinosure also provides support for export financing. In March 2011, in reached an agreement with J.P. Morgan to provide a wide array of financial services to exporters, with SINOSURE covering J.P. Morgan’s exposure.

Sinosure also covers SMEs (since 2005, even those with export volumes of under 2 million dollars a year that are unable to bear the political and commercial risks of international trade. The company also provides coverage for foreign investment by Chinese companies, this time most often by large SOEs.

Foreign companies usually first deal with Sinosure when they have a payment dispute with their Chinese product supplier. When that happens, Sinosure usually steps in and threatens to sue the foreign company with the problems. Sinosure does this by hiring debt collection lawyers in the alleged debtor’s country to pursue the debts of the Chinese manufacturers it insures. Sinosure is very aggressive in pursuing collection outside China so you need to take its threats seriously.

3. Sinosure in the United States: its law firms and collection agencies.

Usually, American company’s first threats come from the Leviton Law Firm or from Brown & Joseph Collection Agency. First a bit of background on the Sinosure players my law firm’s international litigators see again and again. I am providing this to give you background on how Sinosure typically handles its U.S. collection claims and on the people with whom you will likely need to deal.

The first to appear on behalf of Sinosure is usually an Illinois based company, Brown & Joseph, usually Angela Keane of that office. Brown & Joseph calls itself “a commercial and credit collection firm” and it usually starts its Sinosure matters with a barrage of threatening emails, letters, phone calls and even personal visits, stating something like the following (I changed the company name and the amount to remove any identifiers:

Please allow this correspondence to serve as notice that this firm has been retained by China Export & Credit Insurance Corporation (Sinosure) on behalf of their policy holder Dongguan ________Machine, Ltd.

All further communications regarding this matter should be directed to my office.

The claimed amount of default is $545,862.38 in which the policy holder has now filed for credit insurance due to nonpayment.

Your immediate cooperation is needed to resolve this issue out of litigation. Pursuant to the attached Trust Deeds all rights have been assigned to Sinosure to collect this on their behalf.

Your failure to cooperate may result in future import and credit implications of goods from the People [sic] Republic of China.

With that being said, please review the attachments and acknowledge the invoices and amount owed of $545,862.23 for verification purposes.

In addition, I will anticipate your payment in full via wire directly to our firms [sic] escrow account. The wiring instructions are listed below. Please email me with the wire confirmation number and upon receipt I will confirm closure of this case.

Domestic Wire Transfer:

Routing Bank: First Bank & Trust, Evanston IL

ABA: 071925538

Account #: 4084168

Beneficiary: Brown and Joseph, LTD

If you are unable to remit payment in full, you will be required to contact me directly before the end of business tomorrow to discuss a reasonable payment plan for our client to review.

I look forward to your immediate response as I only have a limited time to resolve this file in my office prior to litigation.

This letter threatens both litigation against the U.S. company that allegedly owes money to a Chinese company and it also threatens to impact the U.S. company’s “future import and credit implications of goods from the People [sic] Republic of China.” I am not sure whether the threat to future imports and credit from China is deliberately unclear, but what Brown & Joseph seems to be saying here is that if you do not pay, Sinosure will cease providing insurance on your credit purchases from your Chinese suppliers. If you are buying products from China on credit you need to take this threat very seriously.

If the company Sinosure is pursuing through Brown & Joseph does not fairly quickly reach agreement with Brown & Joseph on resolving the claims its Chinese factory or factories is threatening to pursue against it, The Leviton Law Firm usually steps in. The Leviton Law Firm has this to say about its commercial collections practice:

While not always possible, it was our philosophy and goal to negotiate amicable settlements and workouts between our clients and debtors in order that the parties may attempt to continue their business relationships in this very challenging economic environment.

Note how it says “it was” their philosophy. It’s not clear whether putting this in past tense is a typo, bad grammar, or if indeed its philosophy has changed. But I can emphatically tell you that from my law firm’s dealings with Sinosure (when represented by either the Leviton Law Firm or by Brown & Joseph), I would never in a million years say that either of them have anything remotely approaching an “amicable” philosophy when it comes to acting as Sinosure’s local debt collectors.

4. China Factory Problems Lead to China Sinosure Problems

Though our law firm has written close to a thousand agreements with Chinese factories, not a single one of the companies for which we wrote such an agreement have ever been pursued by Sinosure, at least as far as we know. The reason for this is simple; contracts help prevent China factory problems and Sinosure’s involvement virtually always stems from a China factory problem.

Chinese factories experiencing problems are more likely to ship bad products, no products, and/or late products to foreign product buyers that then refuse to pay in full. Sinosure then steps in to collect the alleged payment “shortfall” from the foreign product buyer. Because so many Chinese factories are having problems these days due to COVID, COVID lockdowns, and various other supply chain issues, our China lawyers have been getting a ton of inquiries from companies that are being hounded by Sinosure, Brown & Joseph, and/or Leviton Law Firm for payment.

The below is a composite of the many sinosure cases our law firm has handled, and it is in many respects a typical Sinosure case:

1. Foreign company (for purposes of this example, a U.S. company) buys $2 million of widgets from Chinese manufacturer.

2. U.S company pays Chinese company $1.4 million upfront for widgets, with the remaining $600,000 to be paid on delivery.

3. The widgets that arrive in the United States are of terrible quality, to the point of being nearly worthless.

4. The U.S. company refuses to pay the remaining $600,000 it allegedly owes its Chinese supplier and it asks its Chinese supplier for new and better product.

5. The Chinese manufacturer goes radio silent and two months later, Sinosure knocks on the door of the American company, via a threatening letter or phone call from one of Sinosure’s U.S. law firms or collection agencies. OR, the Chinese manufacturer and the U.S. company seek to work out a deal and while that is happening, the U.S. company gets a threatening letter or phone call from from one of Sinosure’s U.S. law firms or collection agencies.

6. The U.S. sells the bad widgets at fire-sale prices, netting $850,000 or $550,000 less than the $1.4 million it is already out of pocket to the Chinese company.

7. The Chinese manufacturer threatens the U.S. company with a lawsuit and the U.S. company threatens the Chinese company with its own lawsuit or with counter-claims for “the bad product and for the damage caused to our reputation.”

8. The U.S. company then does nothing for months, figuring there is no way the Chinese company will sue it in the United States and also figuring that suing the Chinese company would be more trouble than it is worth.

9. All of a sudden, a U.S. collection agency/lawyer retained by Sinosure contacts the U.S. company and says that unless the U.S. company immediately pays the remaining $600,000 it allegedly owes to its by now former China manufacturer, Sinosure will soon sue the U.S. company in the United States.

10. The Chinese manufacturer will insist to its U.S. buyer that it never contacted Sinosure and that the U.S. company should just ignore Sinosure. This is virtually never true and it is important that you not fall for this.

11. The Chinese manufacturer will deny that Sinosure has any authority to act on its behalf and it will tell the U.S. company to pay it all or even just some of the money directly and if it does so all will be fine. This is virtually never true and it is important that you not fall for this.

12. In the meantime, Sinosure is likely claiming that if the US company just pays Sinosure, all will be fine. This is also virtually never true and it is important that you not fall for this.

13. Oftentimes, sub-suppliers of the Chinese manufacturer will start contacting the U.S. company to get paid.

14. The U.S. company starts out defiant, telling Sinosure’s collection agency/lawyer that it will never pay anything because it does not owe anything and if the Chinese company sues in the United States, it will counterclaim.

15. The U.S. company then learns that it can no longer buy any of its products on credit from any manufacturer in China because Sinosure put the U.S. company on a list of companies whose China purchases will not be insured. Once a company makes this list, no Chinese manufacturer will extend that company any credit.

16. The U.S. company’s inability to buy from China on credit is tough on them, especially because it is already reeling from having lost money on the bad product it received.

17. The U.S. company then calls our law firm to have us try to work out a “win-win” settlement. We tell them that China virtually never does win-win settlements and this is most certainly true of Sinosure as well. We then map out another plan for them.

5. Real Life Sinosure Nightmares

Most of the companies that retain our law firm to fight Sinosure do so before they “settle” with anyone, but some companies do “settle” with their Chinese manufacturers and that is when the worst of the Sinosure nightmares begins. The below is what can happen to a foreign company that “settles” with its Chinese manufacturer when Sinosure has demanded payment from it.

1. The U.S. company described above does not call our law firm. Instead, it works out a deal with its Chinese product supplier to pay it $450,000 and in return the Chinese company will agree not to pursue any additional amount the U.S. company allegedly owes it.

2. The U.S. company then pays its Chinese supplier the $450,000, believing the emails between it and the Chinese company are sufficient to document its deal with its Chinese supplier.

2. The Chinese supplier is delighted to have received the $450,000, especially since this is in addition to the compensation it has already received from Sinosure under its export insurance policy with Sinosure.

3. The Chinese supplier company does not tell Sinosure that it received the $450,000 because that would require the Chinese supplier send that money to Sinosure — not to mention that it had no authority from Sinosure to do such a deal.

4. The Chinese supplier company is not going to start selling its products to the U.S. company again. Why would it when it cannot get export insurance from Sinosure were it to do so? As far as Sinosure knows, the U.S. company owes Sinosure $600,000 and unless and until the U.S. company pays Sinosure that $600,000, the U.S. company will remain on Sinosure’s blacklist.

5. The U.S. company is in a terrible position. It is now in the hole for the $850,000 it paid upfront to its Chinese supplier, plus an additional. $450,000 it paid to its Chinese supplier, believing that payment would rid it of its China problems once and for all. But instead of its China problems being solved, the U.S. company is having to keep dealing with Sinosure’s incredibly aggressive American law firm that has zero clue about anything China and insists that the American company either never paid its Chinese supplier anything and even if it did, it still owes Sinosure $600,000 because the Chinese supplier assigned all of its claims against the U.S. company to Sinosure.

6. Unable to afford to hire U.S. litigators to fight the lawsuit that has just been or will soon be filed against them and to hire China lawyers to sort through and explain what transpired in China, the U.S. company shuts down its business.

7. Sinosure then threatens to sue the U.S. company owner individually.

You can prevent the above nightmare scenario by not “settling” with your Chinese manufacturer or with Sinosure without making 100% certain that your doing so will actually resolve ALL claims against you. Do not pay anyone anything without first getting a proper written agreement (in Chinese) that makes clear all claims (of both your Chinese manufacturer and Sinosure) have been resolved. This agreement needs to work in both China and the United States and it must be signed and sealed by all parties (including your Chinese manufacturers) or you could face very troubling additional lawsuits down the road.

And this is only if you are insistent on settling. Most of the time we are able to make it so that our clients can start buying from China on credit again, without having to pay Sinosure or its China supplier anything at all.

6. What Makes China Sinosure so Dangerous?

The below is what make Sinsosure so dangerous, along with the extreme basics of what you need to know should Sinosure threaten your business:

1. Do not expect the law firm/collection agency representing Sinosure to know why you have not paid your China manufacturer. These law firms/collection agencies typically get a percentage of what they collect and they rarely care about anything but this.

2. Do not expect the law firm/collection agency representing Sinosure to care about why you have not paid your China manufacturer. These law firms/collection agencies typically get a percentage of what they collect and they rarely care about anything but this.

3. Do not expect the law firm/collection agency representing Sinosure to know the correct amount you actually owe your China manufacturer. Do not even expect them to know whether you actually owe your China manufacturer anything at all. There is a good chance your Chinese manufacturer lied to Sinosure about the situation between you and them and about the amount you owe. Do not expect Sinosure’s law firm/collection agency to care about this. These law firms/collection agencies typically get a percentage of what they collect and they rarely care about anything but this.

4. In our extensive experience handling Sinosure cases — we’ve handled well over 50 Sinosure matters — the only goals of Sinosure’s law firms/collection agencies seem to be to do Sinosure’s bidding. Their only focus seems to be to get Sinosure paid as much as possible as quickly as possible. Their goal will be to get results for Sinosure, not to help you in any way.

5. Do not pay anyone anything without first having a proper written agreement that will prevent anyone from seeking more from you. This agreement should be in Chinese and under Chinese law because if it isn’t there is a good chance that whatever you paid to “settle” your case will not count for anything. This agreement also must make clear that your payment resolves all existing and potential claims by Sinosure and by all relevant Chinese manufacturers. This agreement needs to work in both China and the United States and it needs to be signed by all relevant parties, including your Chinese manufacturers. It also should be sealed, China-style, by the Chinese company or company on the other side. If your agreement does not comply with all of the above, your company likely will face additional lawsuits. There are all sorts of other contractual requirements for these sorts of settlements, but it would take an additional ten pages to go into all of those.

6. There are all sorts of terrible things China Sinsosure can and will do to your business, most of which will happen in China. The first thing it usually does before even reaching out to you is to stop insuring your product purchase payments. They call this putting you on their “black-list”. This is usually just the start. The first thing our law firm does once retained by a company under siege by Sinosure is to build up defenses to Sinosure and to the Chinese factory, both in the United States and in China. These defenses are tailored to our client’s specific situation and goals and we cannot reveal them here because we do not want Sinosure to know what exactly they are.

7. What You Should NOT Do if Under Siege by Sinosure

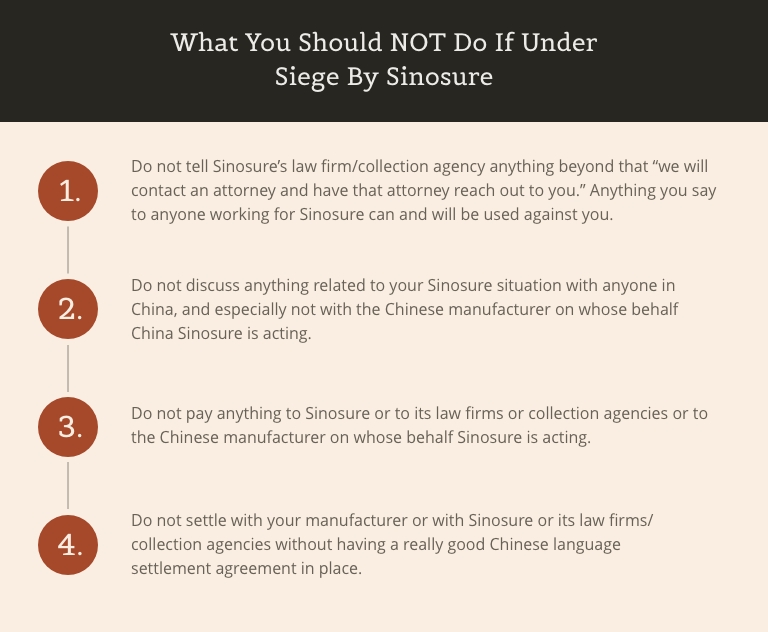

Companies too often contact our law firm after having done something that weakens or destroys their defenses against Sinosure. You likely can avoid hurting your situation against Sinosure by not doing the following:

1. Do not tell Sinosure’s law firm/collection agency anything beyond that “we will contact an attorney and have that attorney reach out to you.” Anything you say to anyone working for Sinosure can and will be used against you.

2. Do not discuss anything related to your Sinosure situation with anyone in China, and especially not with the Chinese manufacturer on whose behalf China Sinosure is acting. Your Chinese manufacturer has directed Sinosure to go after you and it is most emphatically not your ally at this point.

3. Do not pay anything to Sinosure or to its law firms or collection agencies or to the Chinese manufacturer on whose behalf Sinosure is acting. They probably will try to convince you that you paying some of what you allegedly owe will help you, but in our experience it only heightens their lust for blood. There is an old saying in litigation: never fund your enemy. Sinosure and its law firms and its collection agencies and the Chinese manufacturer that sicced those people and entities on you are your enemy. Their only goal is to make money off you.

4. Do not settle with your manufacturer or with Sinosure or its law firms/collection agencies without having a really good Chinese language settlement agreement in place. See paragraph 5 above for some of what that entails. Do not settle with anyone unless and until you have your own lawyer helping you with this agreement and that lawyer must know Chinese and Chinese contract law. In many cases, we can set things up so that you never have to pay anyone anything or settle with anyone.

8. What TO DO if Under Siege by Sinosure

If you are contacted by a law firm/collection agency acting on Sinosure’s behalf, the following are usually (but not always) the best steps to take.

1. The first thing you should do is take it very seriously. If you do not pay Sinosure, it will add your name to a list of foreign companies whose product purchases it will not insure. If Sinosure ceases to insure your China product purchases virtually no China supplier — including those with which you have had a long term relationship — will extend you credit on your product purchases. Without sinosure insuring your purchases, the next time you order $2 million in widgets from China, you will need to pay two million dollars upfront. I should not have to tell you how dangerous it is to pay a Chinese factory the full amount upfront on a purchase.

2. If you are not paying your Chinese supplier because of cash flow problems, neither Sinosure nor its attorneys/collection agencies will listen or care. They want money now and they think you can and should borrow to pay it. Instead of listening, Sinosure and its attorneys (in whatever country they may be in) will seek to make your life miserable by threatening you and by doing what they can to embarrass you.

3. If you are not paying your Chinese supplier because your supplier gave you bad product, Sinosure and its law firms/collection agencies will “listen” only if you do certain key things to “make” Sinosure listen. Sinosure’s lawyers/collection agencies will probably tell you that your reason for you not paying does not matter, but that is just because they want you to pay quickly so they can get their percentage. It will be incumbent upon your lawyer to convince Sinosure that it will be better off listening to your position than suing you in the United States (or your home country) and/or making your business (and even your personal life) a living hell in China. Sinosure is not typically off-base in refusing to listen to product quality complaints because if you do not have a China-centric manufacturing agreement with your Chinese manufacturer that clearly specifies the quality of product you are to receive, Chinese law is almost certainly on the side of your Chinese manufacturer in any event.

4. You must do certain things right away in China and in your home country to prevent Sinosure from harming your company. Together, our law firm’s international litigators and corporate lawyers have developed strategies to protect our clients against Sinosure. These strategies depend on our client’s specific situation and risk tolerances.

There is no one good way to deal with a rampaging Sinosure and the best way for you will depend on your specific contracts, your specific situation, and your specific goals. When our law firm represents Sinosure victims, we typically begin by asking them the following questions:

- How much is being claimed against you? There is no point in hiring a lawyer if the amount at stake is too low to warrant it.

- Why have you not paid? This greatly influences our initial strategies.

- To whom do you owe the money? We usually follow up by asking how important the Chinese creditor is to the debtor’s business. We also research the Chinese creditor simply to know who we are up against. We typically do this by compling a basic due diligence report on that Chinese company.

- Do you have other suppliers in China in addition to the one (or more) Chinese companies that are claiming you owe them money? We are trying to figure out how important it is to solve the Sinosure problem quickly.

- Is it important you be able to continue doing business in China? Exactly what sort of business? These are important questions for determining strategy.

- Do you have people that work for your company in China. We are concerned about a debt hostage situation, which are far more typical than just about anyone realizes. See How to Reduce Your Chances of Getting Kidnapped in China.

- Is it important that you or anyone else in your company be able to go to China? This is an important question for determining strategy.

- Do you use any of your company’s brand names or logos or other IP on any products or packaging made in China? If so, have you registered those brand names or logos in China? Chinese companies frequently register their debtor’s brand names and logos as China trademarks to gain leverage against them. Often, the first thing we do is shore up the IP registrations of a company involved in any sort of business dispute in China because we do not want to go to battle against Sinosure without first patching up a gaping wound.