In a multitude of marijuana-regulated states, certain individuals and companies cannot own or even finance a marijuana business due to state regulations on residency and criminal and financial background checks. This means the cannabis business lawyers at my firm often get clients interested in getting involved with an ancillary cannabis business so as to avoid these heavy regulations.

In a multitude of marijuana-regulated states, certain individuals and companies cannot own or even finance a marijuana business due to state regulations on residency and criminal and financial background checks. This means the cannabis business lawyers at my firm often get clients interested in getting involved with an ancillary cannabis business so as to avoid these heavy regulations.

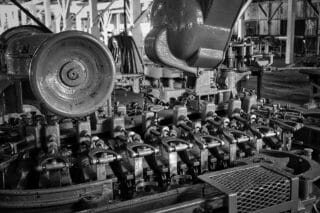

Whether it is technology, real property development, or consulting, how you structure your services or licensing agreement can control whether the ancillary company violates applicable state marijuana regulations. And marijuana equipment leases are no different. Done right, leasing expensive equipment to marijuana producers and processors is a great way to service state licensed marijuana businesses without violating state rules. However, just like real property lease agreements, garden variety off the shelf boilerplate marijuana equipment lease agreements will not cut it in the cannabis space. So here’s what you need to know when leasing equipment to a licensed or permitted marijuana business in a heavily regulated marijuana state:

- Marijuana Regulations: How the Lessor Gets Paid. Every equipment lease agreement must be structured so as not to violate applicable marijuana rules in a given state. This usually means the lease agreement must clearly address how the lessor will get paid and that payment plan cannot violate state law. In a number of states, if the lessor takes an equity interest in the marijuana company in exchange for lease payments, or if the lessor is entitled to receive net or gross profit from the marijuana business, or if the lessor’s equipment lease payments hinge on the marijuana business’s financial performance or harvest or manufacturing yield, the lessor must be disclosed to and vetted by the relevant government agency. Most states require a fixed fee for rental payments and anything different will likely lead the state to believe the lessor is really a hidden profit sharer. The higher the lease payments, the more likely regulators are to think there’s some unlawful profit sharing taking place. Be sure you can defend your above-market-rate charges.

- Marijuana Regulations: Lessor Control Over the Marijuana Company. In addition to lease equipment payments, state regulators also want to know and approve of any person or company exercising any control over the marijuana company. States don’t usually fully define what constitutes an impermissible level of control, but you can assume the definition will be fairly broad and will be analyzed on a case by case basis. In the context of an equipment lease, an impermissible control provision would be the lessor restricting the marijuana business from renting equipment from another equipment lessor. And if the lessor wants to throw in some consulting services as a supplement to leasing the equipment, the lessor’s control over the staff of the marijuana business regarding the use of the equipment may also create a control violation if lessor oversight goes too far.

- Marijuana Regulations: Contract Rules. As an equipment lessor, you have to make sure your lease doesn’t violate any applicable state law contract rules. For example, in Washington State, the term of the contract cannot be indefinite — it needs a termination date. This stems from state regulations prohibiting third parties from locking marijuana businesses in too long to term contracts that could create “undue influence” over the licensee. We constantly see equipment leases that violate this simple rule.

- Security Interests. Make sure your security interest in your equipment is valid. In most states, state regulators should have no issue with a lessor’s security intern est in its equipment. However, if the lessor tries to maintain a security interest in marijuana inventory or ithe licensed business itself, it is going to have a control problem. State receivership proceedings may be another collection option, but you need to make sure that’s a realistic scenario in your state and that your equipment lease carefully details how that will happen.

- Defaults. The rules governing cannabis businesses are unpredictable and ever-changing and this means you as the lessor must stay on top of the rules and make sure you remain in compliance with them. This also means your equipment lease needs to account for very specific events of default that should include the marijuana business having to maintain good standing with regulators and any permissible appeal/cure period if the marijuana business is hit with a marijuana regulation violation that carries shutdown or crippling fines as penalties.

- Access to the Equipment. You can’t just come and check up on your equipment whenever you want. All states control physical access to the marijuana business itself, so be sure your equipment lease takes that into account. Most times, you’re going to have to consent to applicable security procedures, including scheduled visits, the donning of ID badges, and being escorted at all times by an employee of the marijuana business.

- Disputes and Repossession of Equipment. Because many marijuana businesses fail in their first year, you need to be ready for the eventuality of a default on your equipment lease. Your contract should include the right laws and the right venue for your dispute. Since marijuana is still federally illegal, you should consider private mediation and/or arbitration of your disputes and you should ensure that any court filings go through state court, which is more likely to recognize and honor your equipment lease than would a federal court. We sometimes use provisions mandating state court and prohibiting removal to federal court. You’ll also want to give yourself an easy route to repossess the equipment, so don’t ignore the benefit of providing for self-help repossession methods in your equipment lease agreement, so long as they don’t violate applicable marijuana rules.

Just as is true of cannabis commercial property leases, your cannabis equipment leases need to account for all sorts of cannabis-specific situations.