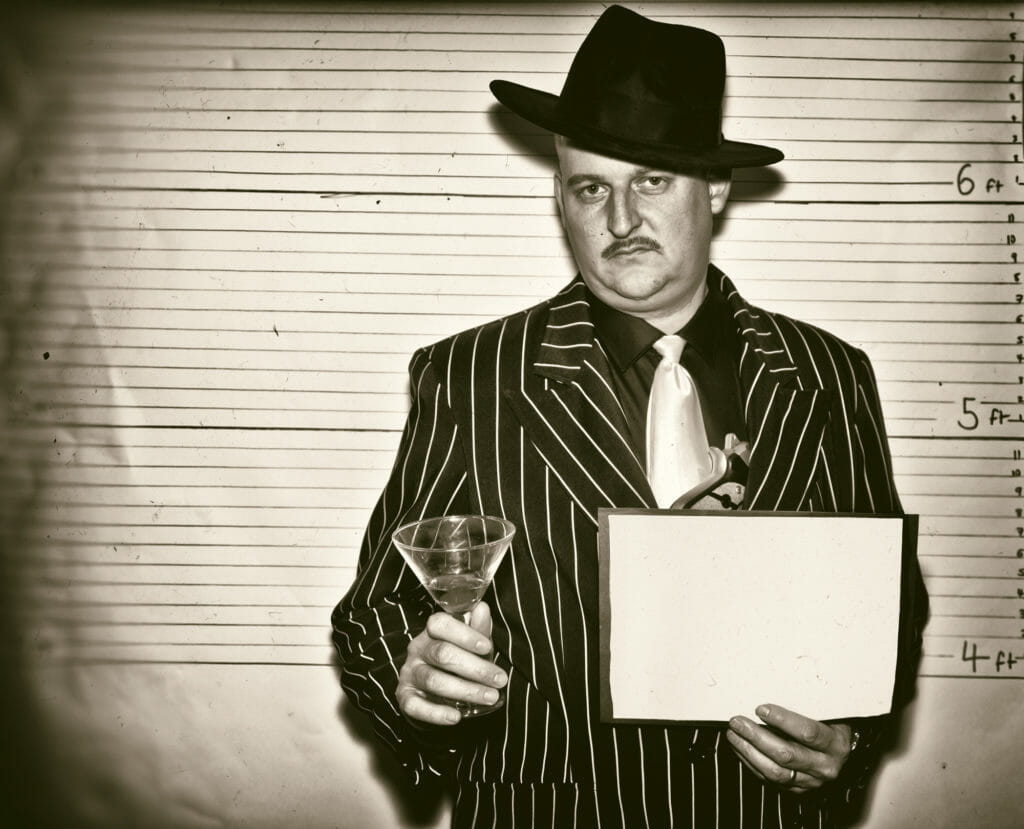

I can’t count how many times I have been talking to a client about a business venture, and I stop them in the middle of their explanation and say, “You just issued securities.” I get a blank stare looking back at me. Then I say, “Securities is one thing you do not want to get wrong as a business owner. You can go to prison for securities fraud if you get it wrong. The consequences are bad – very, very bad.”

Then I get a panicked stare looking back at me, and we proceed to clean up what could have been an awful mess that would cut straight through the “limited liability” protection of their business entity. Federal securities regulators (primarily the Securities Exchange Commission (SEC)) and state securities regulators do not mess around, and they love to nail companies for securities issues (see SEC Sues Cannabis Players for $25 Million Offering Fraud).

I am sorry for doing this to you at the outset, but I need to start with a really long definition. It’s important. I promise. It could keep you out of jail. You need to know what a “security” is, especially if you are a cannabis company. In fact, if your cannabis enterprise has a parallel company that is not a licensed cannabis company – but you issue securities for that company – then you also need to pay attention.

This is true for marijuana companies. It is true for hemp companies. It is true for extraction companies. It is true for packaging companies. It is true for distribution companies. It is true for all companies, including unregistered non-cannabis business ventures carried on by a single person.

According to the U.S. Securities Act of 1933 (and I have trimmed this definition by 50%),

The term “security” means any note, stock, … security future, security-based swap, bond, … evidence of indebtedness, … participation in any profit-sharing agreement, … transferable share, investment contract, … fractional undivided interest in oil, gas, or other mineral rights … option, or privilege on any security, … or group or index of securities … or any certificate of interest or participation in … or warrant or right to subscribe to or purchase, any of the foregoing.

I’m really sorry about that. Let me give you a more helpful summary. In the cannabis industry, a “security” is any type of financial interest in any business venture for any amount over any period of time, even if that business is not a formally registered company. The security could be an offer or sale of a straight equity ownership percentage. It could be a simple loan or debt. It could be an option, warrant for future ownership, or a profit sharing arrangement.

I have done many business deals involving securities. I have represented companies receiving investment funds (these are generally called “issuers”), and I have represented single investors and groups of investors on the front end of an investment where everyone is optimistic and on the back end when everyone hates everyone else and the money is gone.

Virtually every company needs investment funds, and they all hope they will find investors with heavy, loose pocketbooks and an insatiable appetite for risk. Every prospective investor with investment capital hopes that they have found “the one” – the company that will give them a 10x or 100x return on their funds with zero risk.

Virtually every country in the world has securities laws. These securities laws are in place mainly to protect innocent, unsuspecting, trusting, under-informed, and unsophisticated investors from individuals and companies who are either dishonest or untrustworthy. Securities laws are also in place to protect investors from themselves – those who “don’t know what they don’t know.”

And like many laws that were put in place because some people cannot or should not be trusted, everyone else has to learn to color within the lines on pain of serious fines and, in the worst case scenario, imprisonment for fraud. If you as a company or as an investor hear any phrases like this, your ears should perk up because someone just issued securities, and there is a good chance they did not do it correctly:

- I borrowed some money from my parents, grandparents, children, aunts, uncles, or cousins

- My neighbors wanted to invest

- My college friends said they would give me some money but probably wouldn’t be able to help in the business

- I told Judd Smith if he let me plant in his greenhouse/on his land free of charge, I’d let him have a cut of the profits when we harvest

- It’s just a handshake loan

- It’s just a promissory note

- She said her lawyer said that we needed some kind of offering memorandum or document before she can invest

- We only used a term sheet, and they wired the money to us last week

- It’s just going to be a quick loan

- It’s just going to be a quick turnaround investment. I told them they would get a 50% return on their investment.

There are absolutely many right ways to issue securities, but I have never seen a company do it on their own without the help of competent experts.

In future posts, I will continue discussing cannabis securities laws and regulations with an eye to help investors keep their funds relatively safe, to help companies attract and retain good investors, and to help business owners from staying out of prison.

For more reading, check out: