The below is what our China company formation lawyers have been telling our clients about China’s new minimum capital requirement rules when forming a WFOE.

Note that China the country has its laws/rules on this and many of China’s cities have their own rules on this as well. And in addition to the rules “on paper,” you also must consider local “customs”. With all of these provisos, here is the email we have been using with our clients for whom we are forming a Shanghai WFOE.

We are required to set forth the registered capital for the WFOE. The rules on registered capital have changed substantially in the past two years. Here is the basic situation today:

1. Registered capital is the amount of capital (not earnings) required to get a WFOE started. This amount is typically based on the amount of money needed by the WFOE before the WFOE starts earning sufficient income to cover its financial obligations. This amount is unique to every WFOE. For a WFOE that will build a petrochemical plant, the number may be over a billion dollars. For a two person consulting WFOE, the number will likely be quite small.

2. China now has no formal requirement for the amount of registered capital. The Jingan local government recommends registered capital at least equal the first two years expenses of the WFOE. However, there is no fixed rule.

3. There is no longer a requirement on when the capital must be contributed and there is no fixed rule on the amount of each contribution of capital. There must be enough capital to cover the operations of the WFOE. In particular, there must be enough capital to cover employee salaries, rent, utilities and government charges and taxes. It is a violation of law to start a business in China if these basic expenses are not covered by the capital contribution. The government generally requires total registered capital be contributed within 20 years, which effectively means there is no time pressure on the contribution.

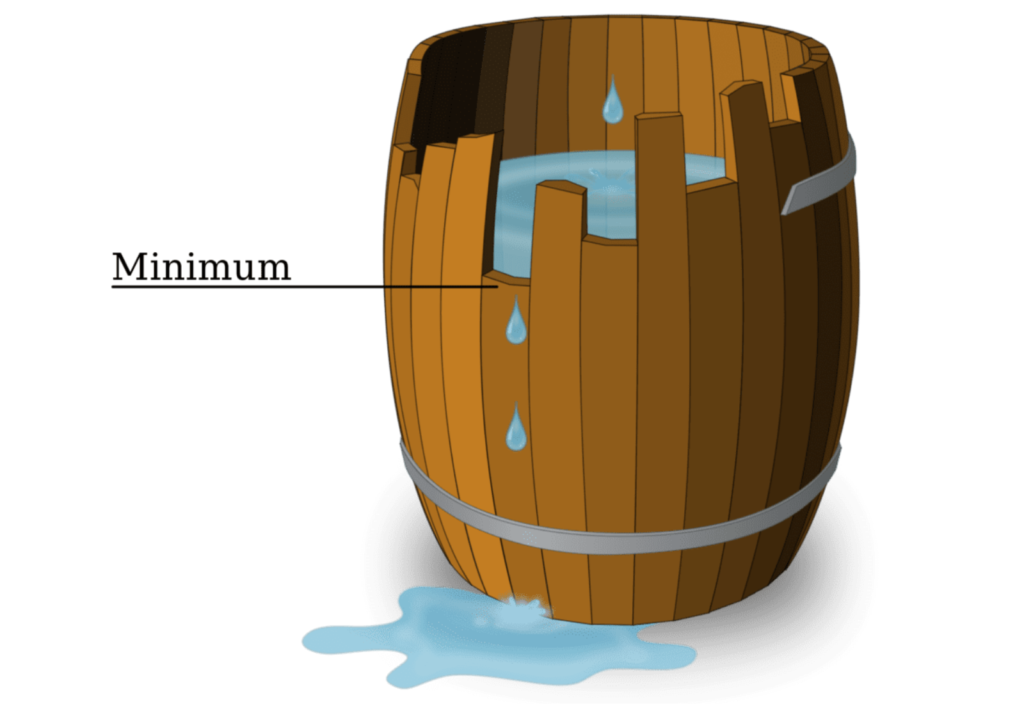

4. The source of both capital and income for this WFOE will be payments from the shareholder (your U.S. entity). Under Chinese law, payments from the shareholder that exceed the registered capital amount are treated as income to the WFOE and are taxed at China’s normal income tax rates. Capital contributions, on the other hand are not taxed. This is why you should be careful not to set your minimum capital too low.

5. The following are the two common approaches for determining the appropriate registered capital amount:

a. Use the local government recommendation of an amount equal to the first two years expenses of the WFOE (the “rule of thumb” approach).

b. Work with your accountant to determine an appropriate amount (recommended). If your accountant is not able to handle China and cross-border accounting issues (most are not), let us know as we work with a number of such accountants and we would be happy to recommend one to you.

For us to assist you in determining an appropriate registered capital amount, we need to see the following:

a. Projected expenses for the first two years of WFOE operations.

b. Projected sources of income to the WFOE in the first two years of WFOE operations:

i) As payments from the shareholder.

ii) As payments from the affiliates of the shareholder (if any).

iii) As income payments received from unaffiliated third parties (if any).

c. Five year projected pro forma for the WFOE.

We do not need this financial data if you will make the decision working with your accountant or by adopting the rule of thumb method.

6. We need to provide the registered capital amount at the beginning of the WFOE application process. You therefore should make the determination of the registered capital amount a top priority matter.

Please contact me if you have any questions on this.