This is our first installment in what will be an intermittent state by state series on “The Top Ten Things to Know to Start a Cannabis Business.” We figured we would start with Washington State because that is where our cannabis business lawyers got their start back in 2010. Washington recently combined its medical and adult use industries into one industry, both of which will be governed by the Washington State Liquor and Cannabis Board (the “Board”).

The below are the top ten things you should know before you start down the road of opening and operating a cannabis business in the Evergreen State.

1. You can’t just open your doors; you need a license from the Board. Unlike Washington’s old medical marijuana industry, you cannot operate a marijuana business without first receiving a cannabis license from the Board. Getting that license requires you to either 1) pay $250 to apply for a license from Business Licensing Service (when the Board opens the window for the license you want) and go through a relatively arduous licensing process that can take months to complete or 2) buy a business that already holds one of these licenses. With respect to your first option, I note that the most recent retail window just closed on March 31st, and the license window for production and processing licenses has been closed since December 2013. With respect to the second option, you will need to meet residency and criminal background check requirements and secure Board approval before the sale can actually go down. Buying a Washington State cannabis business also means you will be dealing with valuations that are all over the map.

2. Not just anyone can get a Washington State cannabis license.

- Residency. With passage of House Bill 2136, Washington’s residency requirement to own a marijuana business increased from three to six months. Proof of residency with the Board ranges from date stamped IDs and driver’s licenses to utility bills and leaseholds in your name. The Board has shown no signs of dropping its residency requirements (unlike Oregon).

- Criminal background checks. Washington adheres to a criminal point system for license issuance. If you receive eight or more points on the scale, you’re automatically out of the running. If you have a felony conviction within the past ten years, you automatically receive 12 points. If you fail to disclose your criminal history (including traffic violations over $25 and even juvenile crimes) to the Board, you can pretty much count on being denied a license. The points rubric is here.

- True Parties of Interest. Under WAC 314-55, a “True Party of Interest” is anyone who either exercises any “control” of the company (a term which is undefined) or who receives or is entitled to receive either net or gross profits from a licensee. Failure to disclose a True Party of Interest leads to instant cancellation of a license.

3. Financing will be a pain. The Board defines “financiers” as any individual or entity “other than a banking institution, that has made or will make an investment in the licensed business. A financier can be a person or entity that provides money as a gift, loans money to the applicant/business and expects to be paid back the amount of the loan with or without interest, or expects any percentage of the profits from the business in exchange for a loan or expertise.” All financiers and their spouses must meet all residency requirements and pass all criminal background checks. This means most money coming into Washington’s marijuana marketplace comes from friends and family of licensees, especially since it is still a challenge to secure bank financing. This might change though since the Board has proposed rules to allow out of state lending (not ownership) beginning in June.

4. You can’t just open anywhere. Washington State has all sorts of requirements as to where cannabis businesses can locate, and it is the rare city or county that does not add on its own more strict requirements. At minimum, you need to be aware of the following:

- The 1,000 foot buffer. Washington State requires all marijuana businesses be at least 1,000 feet away as the crow flies, property line to property line, from the multiple structures listed in WAC 314-55-050(10). However, House Bill 2136 allows cities and counties to lower this buffer (by ordinance) to as low as 100 feet from theses structures, with the exception of schools and playgrounds.

- Local law compliance. House Bill 2136 also ended the game of chicken between licensees and local governments, and it provides that cities and counties can opt out of allowing marijuana businesses in return for giving up any tax revenue from marijuana sales. Many cities and counties have their own regulations on where marijuana businesses can go and many have their own buffer requirements, sometimes even between licensees. You must know local law before setting up your cannabis business.

5. You can be a “transporter,” but you can’t “deliver.” House Bill 2136 creates a third party transport license (which the Board has yet to really regulate) that allows transporters to carry cannabis product to and from licensees. But — and listen up here — no marijuana licensee can deliver any product to consumers. Yes, we know some are currently violating the law, but we also know that the police are cracking down on this and that there is interest from dispensaries in bringing a class action lawsuit against these delivery companies and their owners and employees.

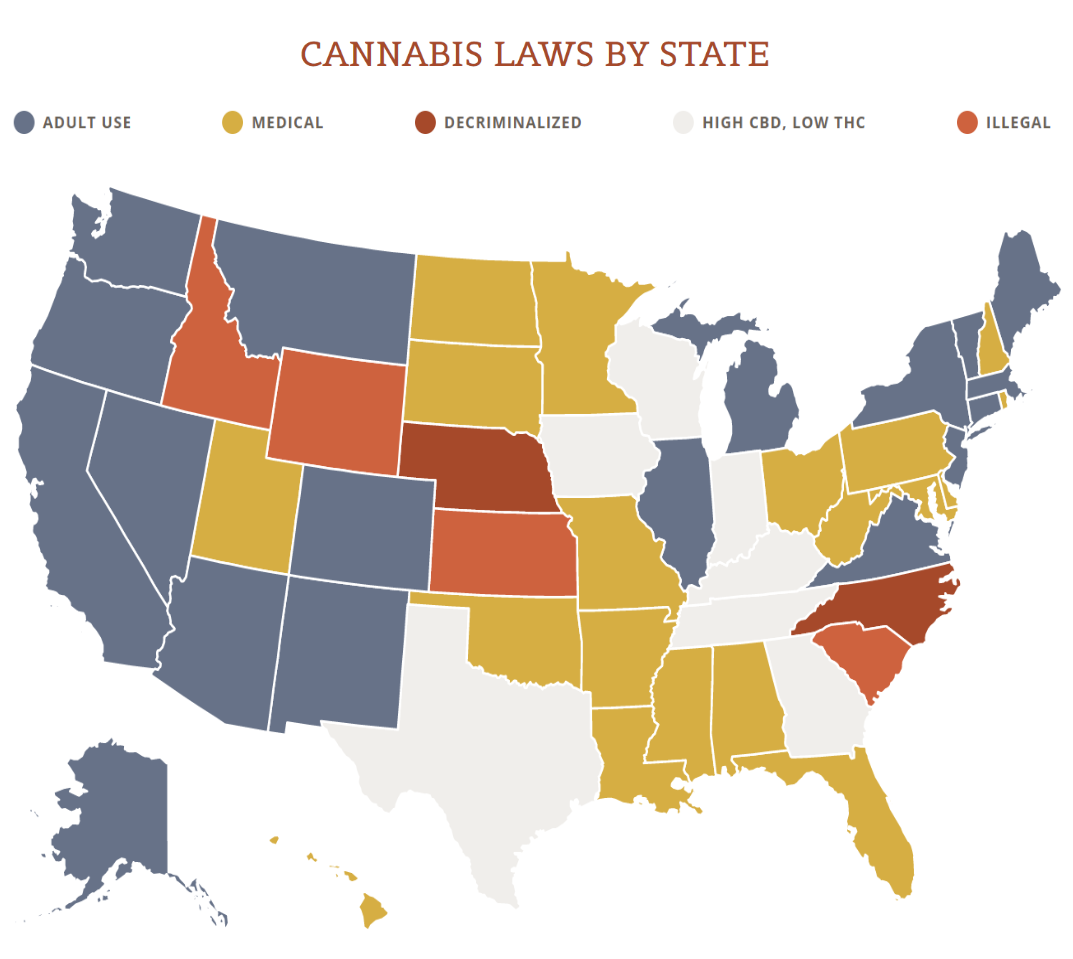

View the US Map of Marijuana Legality

6. You cannot vertically integrate and the taxes have changed. Washington has tied house licensee rules. You can retail but you cannot also produce and process cannabis (and vice versa), and any indirect or direct financial interest between production/processing and retailing will quickly earn you an administrative violation notice from the Board. Moreover, though you can operate up to three licenses in both retail and processing, you cannot have more than one production license (even though the rules allowed producers to apply for up to three production licenses in 2013). Lastly, beginning on July 1, 2015, marijuana taxes changed. Now, a 37% excise tax (to be held in trust for the state) is only assessed at the retail level.

7. You’ll probably be able to get a bank account. Thankfully, several credit unions and regional banks in Washington are following FinCEN guidelines and providing financial services to cannabis licensees. The linchpins to getting a bank account are getting a license and coming across as credible, professional, and prepared to your bank.

8. You can’t just make changes to your business plan or location. Almost everything you do with your business once it has been licensed must get Board approval. If you want to significantly change your operating plan or relocate or sell your business or take on new owners or investors, you must first secure Board approval.

9. The collective garden model is no more. Senate Bill 5052 moved all medical cannabis into the recreational marijuana system to be governed by the Board and the Board has quickly moved to get as many medical marijuana collective garden retailers as possible into the system, by among other things, increasing the number of retail stores from 334 to 556. And come July 1 of this year, the old collective garden model will be officially dead. Though collective gardens may still exist, they will be highly regulated and extremely restricted in what they can do. And though I-502 retailers can apply for medical marijuana endorsements from the Board, the Washington State Department of Health has determined that “medical grade marijuana” is whatever a qualifying patient deems it to be. Here’s the kicker though: if a qualifying patient wants to forego having to pay sales tax on his or her cannabis purchases in Washington State or be able to possess more than an ounce at a time or be able to grow at home at all, he or she will need to register with the Department of Health.

10. Compliance is going to be a big and constantly changing part of your life. It seems like Washington State’s cannabis regulations change on at least a monthly basis. For example, just this month, the Board released emergency rules to address recalls and laboratory quality assurance accountability. The Board also regularly issues “enforcement bulletins” to let the public know the Board’s interpretation of the rules and how it will punish violations. Washington’s cannabis industry is heavily regulated and that means that there are a lot of regulations, that they change all the time, and that they can make or break your cannabis business. Most importantly, this means that you must remain ever vigilant regarding proposed rules, adopted rules, and emergency rules, as all of these will inevitably impact your bottom line.

Need Help With Washington Cannabis Law?